2023 plastics & packaging M&A deals expected to be brisk again: Blaige & Co.

Edited by Mark Spaulding, The Converting Curmudgeon

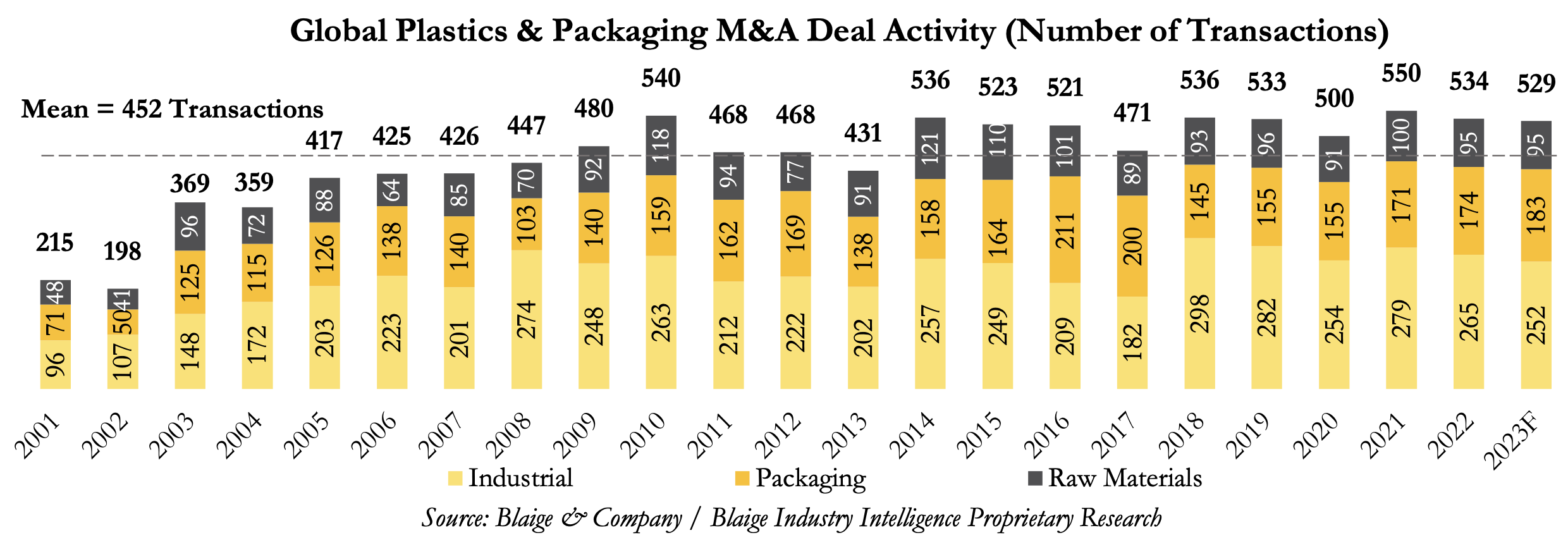

Based on a just-released Market Study from Blaige & Co., 2022 was an active year for M&As in the

plastics and packaging industries. While the total deal

count decreased from the 2021 record of 550 deals to 534

in 2022, the deal count still remains strong into 2023, well

above the long-time average of 452.

Flexible Packaging saw continued strength in strategic

deal activity:

- Dazpak Flexible Packaging (H.I.G. Capital Partners)

completed three add-on acquisitions.

- PPC Flexible Packaging acquired Plastic

Packaging Technologies (former Blaige client).

- Sigma Group acquired Marflex M.J. Maillis.

- Blaige represented WePackItAll, a company at the

forefront of stick-pack packaging, on its sale to Akoya

Capital Partners.

Flexible Packaging also had many global mega-deals

including:

- Apollo Global Management acquired Novolex(Carlyle

Group), EV: $6 billion.

- SIG Group AG acquired Scholle IPN,

EV: $1.53 billion; EV/EBITDA: 15.1x.

- Sealed Air acquired Liquibox (Olympus

Partners) EV: $1.15 billion; EV/EBITDA: 13.5x.

Labels saw a tremendous amount of financial sponsored

add-ons. AWT Labels and Packaging, Brook & Whittle,

Fortis Solutions Group, All4Labels Group GmbH,

Resource Label Group, and I.D. Images all completed

three or more add-ons, and as a group, the six completed

nearly 30 acquisitions in 2022.

2023 Outlook and Recommendations

Overall, Blaige is projecting 529 plastic and packaging deals in 2023, a slight decrease from the 2022 total deal count of 534.

Blaige expects consumables-related industries, such as flexible and rigid packaging, to remain strong. We

predict a 5% increase in packaging-related deals in 2023 compared to 2022, and a 2% increase in raw-material deals. We

expect a decline in cyclicals industries and businesses due to macroeconomic headwinds that will negatively impact

industrials-related M&A, which we predict will decrease 5% compared to 2022. Capital-goods-related segments, such as

machinery and segments with exposure to the building / construction and transportation industries are most at risk.

Well-performing niche processors and converters can demand premium valuations in both strong and weak economies, as

Blaige has proven over the past several decades. Owners who are contemplating a sale or recapitalization in the next few

years should move sooner versus later to lock in the current plastic and packaging M&A-market euphoria, Blaige advises.

Based on its understanding of the plastics and packaging markets, Blaige recommends that processors commit to

growing up to $100 million in sales or more to secure a solid competitive position. Today’s decisions may

potentially become life-changing for owners, their organizations, and their heirs. A sophisticated approach to the sale,

benefitting from a vibrant and expansive bidding process, is more than ever vital for the future of these companies.