CC Blog: Global packaging M&As recover in 2021 with $19.4 billion in deals

Edited by Mark A. Spaulding

The packaging sector experienced very strong transaction

volumes in 2021, according to a new report from Chicago-based Mesirow Financial. Key M&A

drivers were robust demand aided by pandemic tailwinds,

strong valuations and an abundance of capital among strategic

and financial buyers.

Packaging companies will continue to

experience elevated M&A activity in 2022, especially as

consumer e-commerce behaviors and demand for sustainable

packaging drive further values within the sector, and as

strategic and financial buyers leverage their capital access to

pursue accretive acquisitions, the study says.

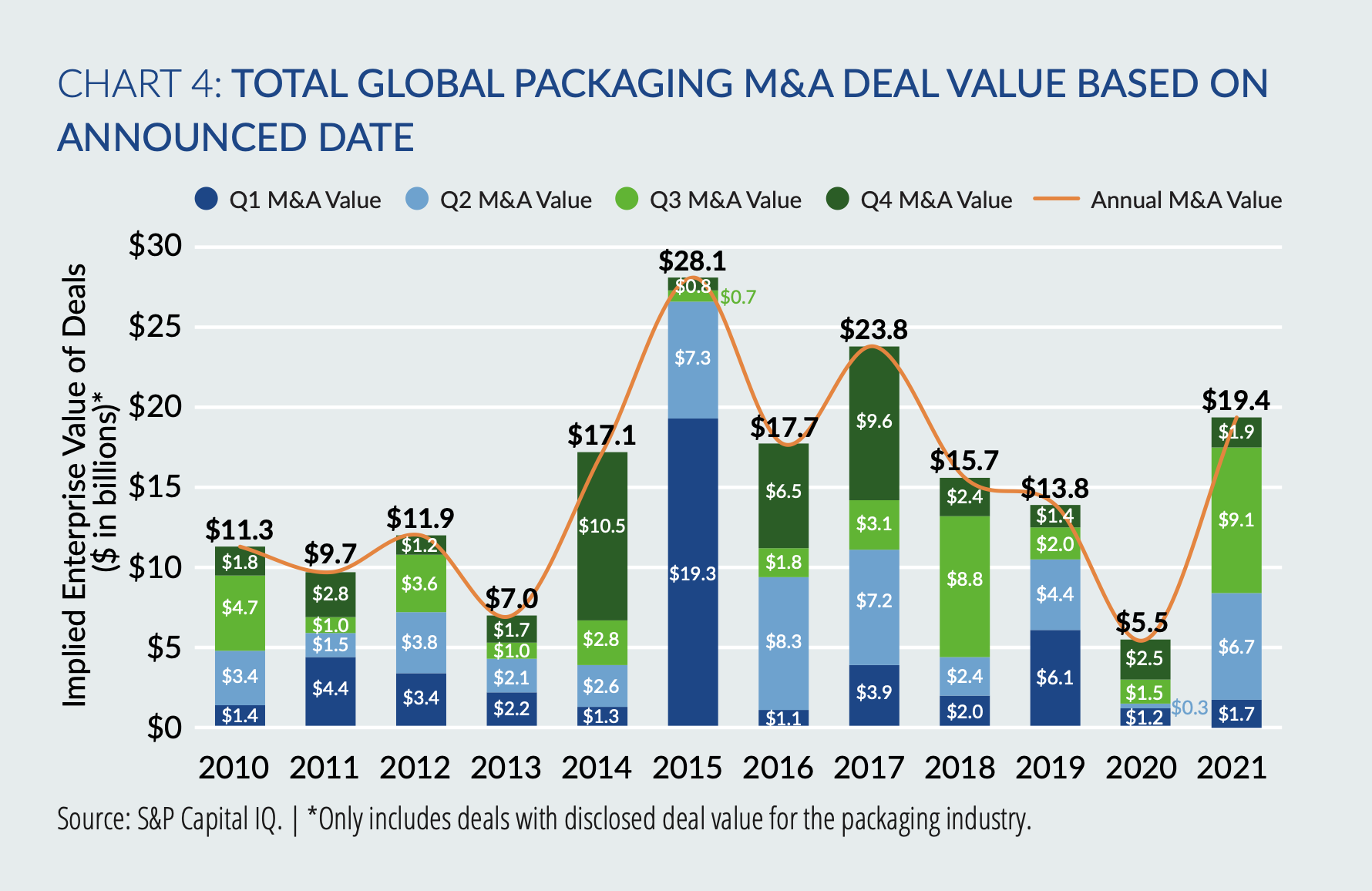

M&A activity in the packaging sector started strong in Q1 2021, surpassing deal

values from Q1 & Q2 2020 combined, and grew rapidly in Q2 2021. In Q3 & Q4 2021, M&A activity grew to yield the highest values

in 2021 compared to the past three years (see bar chart above). M&A activity is anticipated

to remain strong in 2022 for the following reasons:

-

With COVID-19 continuing to impact societies and economies globally, the

packaging sector will remain a primary beneficiary, especially as changes in

consumer lifestyle and shopping patterns. See my post, “How COVID-19 Changed Packaging Forever,” to learn how COVID is transforming

the packaging industry and how producers can stay ahead of the trends.

-

Niche companies offering specialized packaging solutions are well-positioned

to capture accelerating market demand.

-

Financial buyers are using "buy-and-build" strategies to establish industry

portfolios with abundance of capital (over $1.9 trillion of “dry powder”).

-

Strategic buyers are looking for acquisitions to obtain growth, scale,

diversification and synergies.

-

Pricing and leverage levels for debt capital remain favorable.

Private equity continues to be a very

active M&A participant in the packaging

sector, as many packaging subsectors

exhibit:

-

Above-average demand growth

rates, with tailwinds provided by

consumer and e-commerce demands.

-

Defensive demand characteristics,

especially during periods of

economic downturns.

-

Meaningful presence in attractive

end markets, including healthcare

and food and beverage.

-

Attractive margins.

-

Relatively low margin volatility as

packaging companies typically pass

through raw-material cost changes.

-

Low capital expenditure

requirements and high free cash-flow

generation.

-

High degree of fragmentation

resulting in numerous opportunities

for consolidation and growth.

There have been numerous successful

examples of private-equity firms making

an initial acquisition, establishing a

platform company and subsequently

making add-on acquisitions. These

additions increase scale, enhance

manufacturing capabilities and product

offerings, expand geographic presence

and improve cost structure, resulting in

higher valuation multiples.